Overseas Investors Have a Strong Attraction to Israel

January 1, 2016

1. PricewaterhouseCoopers: Israeli mergers and acquisitions (M&A) totaled $12.6bn in 2015, a 73.3% increase over 2014 ($7.25bn). Moreover, 62 Israeli companies were acquired for $7.2bn, compared to 52 companies and $5bn in 2014, a fifth year in a row with over $5bn. Overseas investment in Israeli companies reached $6.5bn, compared to $3.8bn in 2014, a 71% increase. 2015 experienced a rise in the number of investors from the US, China, Hong Kong and Canada. Israeli entrepreneurs and developers are less inclined to sell early-stage startups, investing more resources to reach mature stage, hence the higher price per transaction/investment (Globes business daily, December 28, 2015).

2. Bloomberg (Dec. 18): “”Israel’s economic activity continues to grow, following a year with slightly weaker performance. Israel’s economy is expected to be one of the fastest growing among developed countries….The appreciation of the Israeli Shekel against the Euro and the dollar in 2015, despite the rise in US interest rates, is due to improving Israeli fiscal balances, optimism in the development of Israel’s large offshore natural gas fields, and a sustained strong economy…. Israel’s technology sector is a world-leader in a range of established and disruptive new tech areas…. Israel is home to scores of innovative companies bringing cutting-edge technologies to the global marketplace, [such as] advanced cybersecurity, medical technology, info tech and defense technology that protect airliners from terrorist missiles….”

3. Microsoft acquired Israel’s cyber Secure Islands for $100mn-$150mn, its 5th Israeli acquisition in a year. In July, 2015, Microsoft acquired Adallom for $320mn, in April – N Trig for $30mn, in January – Equivio for $50mn and in November, 2014 – Orato for $200mn. In April, 2015, Canada’s BlackBerry acquired a similar Israeli cyber company, WatchDox (Globes, Oct. 22). The American Direct Energy acquired the Israeli startup, Panoramic Power, for $60mn (Globes, Nov. 13).

4. Israel’s Cybereason raised $84mn in two rounds led by Japan’s Softbank Telecom, joined by the Boston and Cambridge-based Spark Capital and CRV fund (Globes, October 14). Israel’s GreenSoil food technology fund raised $60mn from private investors (Globes, Nov. 24). Israel’s Alcobra raised $40mn on NASDAQ (Globes, November 16). The Silicon Valley-based Third Point Ventures led a $25mn round by Israel’s SentinelOne, joined by the US-based Tiger Global Data Collective, Granite Hill Capital Partners, etc. (Globes, Oct. 14). The US-based NEA Capital, Eric Schmidt’s Innovation Endeavors and Bessemer Partners led a $22mn round by Israel’s Illusive Networks (Globes, Oct. 21). South Korea’s Korea Investment Partners, MAVI and DSC Investment and Sweden’s Flerie Invest invested $12mn in Israel’s Kahr Medical (Globes, Dec. 16). The Silicon Valley’s Sequoia Capital led a $13mn first round of private placement by Israel’s Lemonade (Globes, Dec. 9).

5. Bloomberg, Dec. 1: “Chinese investors pour money into Israeli technology startups [which exceed 7,000]…. Chinese investors are a common sight in Israel …. Technology investment from China is growing 50% annually…expected to reach $500mn in 2015, up from nearly nothing in 2011…[could] reach $10bn by 2020…. A China-Israel Technology and Investment Summit in January, 2016 will host more than 1,000 attendees…. The Hong Kong-based Radiant Venture Capital has invested in 8 Israeli startups….” Israel’s Lumenis was acquired by China’s XIO Private Equity Fund for $510mn (Globes, October 13). China’s Sinopharm and HLST signed a letter of intent for a $50mn investment and licensing agreement with Israel’s Oramed (Globes, Dec. 1). A Chinese and a Taiwanese venture capital funds invested $6mn in Israel’s IOptima, following a $7mn investment in IOptima’s parent company, BioLight, by Patrick Lau from Hong Kong (Globes, Nov. 25).

6. Israel’s global giant, TEVA Pharmaceutical Industries, raised $6.75bn in order to finance its acquisition of Allergan Generics for $40.5bn and Mexico’s Rimsa for $2.3bn (Globes, Dec. 4). TEVA – which employs more than 2,000 employees in Japan – concluded a joint venture with Japan’s $39bn Takeda, succeeding the 2008 joint venture with Japan’s Kowa and the acquisition of Japan’s Taisho and Taiyo in 2011 (Globes Dec. 1).

7. 1,500 new start-ups were established in Israel during 2015 (Globes, Dec. 23). 3,000 overseas Israeli researchers negotiate employment in Israeli academic institutions and businesses (Globes, Dec. 24).

8. The $90bn 3M (Minnesota Mining and Manufacturing) inaugurated an innovation center in Israel, joining other global giants which leverage Israel’s brainpower. H.C. Shin, 3M’s Vice President: “We have been operating in Israel for 20 years…. Why Israel? Because Israel is economically stable….” 3M invested in two Israeli startups, (voice identification) VocalZoom and (water infrastructure monitoring) Takadu and acquired one company, (remote monitoring) Dmatech, for $230mn, currently sensor-related Israeli startups (Globes, Dec. 18). Germany’s engineering and electronic multinational giant, Bosch, is establishing a research and development center in Israel (Globes, Dec. 10), joining some 250 similar centers established by global companies in Israel (Intel operates four such centers and Microsoft two).

9. Israel’s Elbit won a $200mn bid for the sale of medium-size, multi-payload unmanned aerial vehicles to Switzerland (Globes, November 27). According to Globes (Dec.30), Israel’s exports experienced a very mild 7% decline (totaling $92bn in 2015), compared to the steeper decline of other advanced economies, and against the backdrop of global economic slowdown. Israel’s hightech export increased in 2015 ($37.5bn), as was the overall export to Asia ($11.4bn) and the USA ($10.8bn).

By: Yoram Ettinger

Similar posts

-

Israel Has The Most Moral Military In The World

April 10, 2024In the heart of a region often riddled with conflict, Israel stands out not only for its technologi...

-

The Resilience of the Israeli People

April 2, 2024Visitors from around the world have seen Hamas's October 7th Massacre's destruction in southern Isr...

-

Israel: Small Size, Big Impact

March 21, 2024Nestled along the eastern edge of the Mediterranean Sea, Israel is a land of immense historical sig...

-

Israelis Are Fighting For Their Lives

February 21, 2024By Jonathan S. Tobin The world looks a lot different from Kibbutz Kfar Aza than it does in the U...

-

Over 2 Million Arabs Live In Israel

January 23, 2024In the complex landscape of the Middle East, where diverse cultures and identities intersect, Israe...

-

'Fauda' Star Idan Amedi Injured Fighting in Gaza

January 8, 2024Despite the severity of his injuries, Amedi's father assured Israeli news channels that his life is...

-

Israel Is A Great Country To Live In

December 28, 2023Nestled at the crossroads of the Middle East, Israel stands as a vibrant and dynamic nation, offeri...

-

Dear World: I Don't Care

November 2, 2023By Avi Lewis I don’t care that you sympathize with Hamas I know you wouldn’t tolerate any of ...

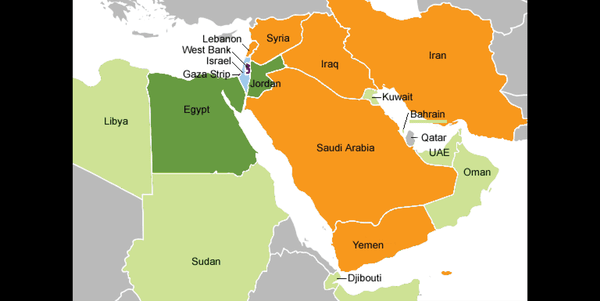

You gotta hand it to Israel, for such a tiny little place on the map they sure keep innovating. Maybe it’s the fact that they are all alone in that part of the continent and that keeps Israel busy on improving. Working on Medicine, Technology, Arts and many other things. I’m impressed.